Intelligent Trade Systems

Applied trading intelligence

for systematic managers.

We are a discrete AI research studio for asset managers who already know how to trade—and want their signals, data and execution to be much, much sharper.

About Us

Independent AI R&D for trading firms

Most managers don’t need another “platform”. They need a small team who understands both modern machine learning and the realities of live trading. Intelligent Trade Systems works behind the scenes with systematic and quantitative managers to refine the machinery of their trading. We clean and structure your data, interrogate your signals, and stress-test your ideas—turning intuition and in-house research into robust, production-ready strategies.

What we care about

Clean inputs

Unreliable data destroys good ideas. We specialise in taking messy, vendor-sourced and internal data and turning it into stable, trade-ready inputs.

Signal integrity

A backtest is not a P&L. We differentiate genuine structure in the market from artifacts, overfitting and data leakage.

Operational realism

Every model we touch is evaluated in the context of capacity, execution costs, slippage, and risk limits—not just in a Jupyter notebook.

Independent AI research and development for institutional trading firms.

Data scale

Curated research data

Long-horizon, tick, fundamental and alternative data maintained for model development.

Team depth

PhD & MSc researchers

Advanced degrees in mathematics, machine learning, statistics, chemistry, and physics.

Compute / simulations

Strategy simulations yearly

Walk-forward, adversarial and regime-shift tests across multiple universes and styles.

Signal / model scrutiny

Signals audited to date

Independent integrity checks on in-house and third-party models before capital deployment.

Our Expertise

Quantitative specialists with real-market experience

The team at ITS is made up of quantitative researchers and engineers whose time is split between formal research and the practical realities of running systematic strategies.

Our backgrounds include:

- Doctoral and master’s work in mathematics, machine learning, statistics and optimization

- Experience building and maintaining systematic strategies across equities, ETFs, futures and options

- Long-term collaboration with CIOs, heads of trading and in-house quant teams under strict confidentiality

We are used to working anywhere along the stack:

- From raw tick and order-book data to factor libraries and compact factor models

- From interpretable statistical models to deep-learning architectures where they are justified

- From exploratory prototypes to code that your engineering team can harden and deploy

We fit into existing teams and infrastructures rather than replacing them. The output is not a black box but clear research, transparent code and defensible conclusions that can be reviewed, challenged and owned internally.

Our Services

From raw data to live-ready strategies

We offer a modular set of services that can be engaged separately

or as an integrated research program.

Data Sanitisation & Optimisation

We turn heterogeneous, noisy data into a reliable foundation for research and trading.

- Vendor reconciliation and corporate action consistency

- Outlier detection, error correction, and missing-data handling

- Feature engineering pipelines tailored to your style (stat-arb, trend, options, intraday, etc.)

- Latency and timestamp alignment for multi-venue feeds

Pattern Integrity Analysis

Not every pattern deserves capital.

We interrogate your existing signals and models to assess whether they are likely to survive contact with the real market.

- Overfitting and data leakage diagnostics

- Regime-sensitivity and robustness testing

- Cross-asset and cross-universe validation

- Stress testing under liquidity and volatility shocks

Trade Strategy Validation & Improvement

We take existing ideas and subject them to independent scrutiny.

- Independent replication of your research results

- Walk-forward, out-of-sample and adversarial testing

- Model simplification without loss of edge

- Incremental enhancements to alpha, hit-rate and risk-adjusted returns

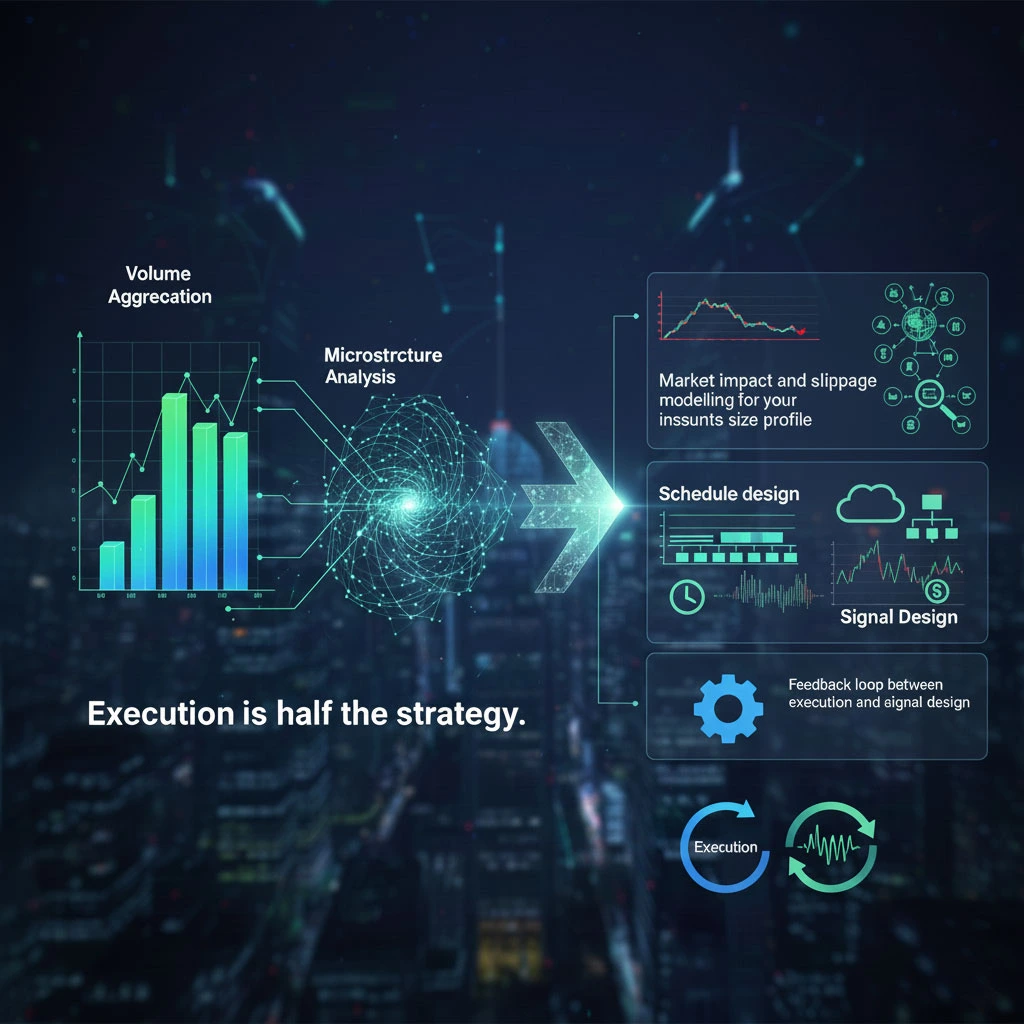

Volume Aggregation & Microstructure Analysis

Execution is half the strategy.

- Volume and liquidity aggregation across venues

- Market impact and slippage modelling for your instruments and size profile

- Schedule design (TWAP/VWAP variants, liquidity-seeking, conditional participation)

- Feedback loop between execution and signal design

Bespoke Research Mandates

For managers with specific questions, we design bespoke projects around:

- New data set evaluation and monetisation

- Regime detection and portfolio re-allocation triggers

- Cross-sectional vs. time-series blend optimisation

- Risk overlay research for existing books

Pedigree & Approach

Low profile by design, selective by choice

Intelligent Trade Systems was founded to fill a specific gap: highly specialized,

trading-literate AI research that is not packaged as a product, fund, or “black box platform”.

Our researchers are drawn from PhD and MSc programmes at institutions such as Imperial College London, ETH Zurich, and the University of Oxford, with training in mathematics, machine learning, statistics, optimisation and financial engineering. We maintain formal relationships with these and other academic centres, and continue to publish peer-reviewed work alongside our applied research at ITS.

That combination—frontier academic work and day-to-day exposure to live trading environments—anchors the way we approach problems: rigorous, sceptical, and focused on what survives in production.

Our clients typically:

- Run systematic or semi-systematic strategies already

- Have in-house quants or data scientists, but limited bandwidth

- Want an external, technically credible view on their data, signals and models

- Prefer to keep their own name in front of investors and allocators

We work with a small number of firms each year so we can go deep rather than wide. Each engagement is tailored, with clearly defined deliverables: research reports, code, documentation and, where appropriate, live-test recommendations.

No marketing lists. No press. No logo walls. Just quiet, durable work that improves the quality of your decisions.

How We Work

Engagement model

We can work with on-premise infrastructure, secure remote environments,

or controlled cloud instances, depending on your security requirements.

-

Discovery call:

We discuss your current setup, datasets, strategies and constraints under NDA. -

Scoping & proposal

We define a concrete research brief, deliverables, timelines and fee structure.

-

Execution

Our team works in close contact with your CIO, quant lead or head of trading, providing regular check-ins and intermediate results. -

Handover

You receive documented research, code and recommendations that your team can maintain and extend.

Contact Us

Let’s talk about your research backlog

Intelligent Trade Systems works with systematic and quantitative managers across regions and styles. If you have data you are under-utilising, signals you don’t fully trust, or strategies you want independently validated, we’d be happy to explore whether we’re a fit.

Start the Conversation

Tell us a bit about your firm, your current strategies, and the type of research support you’re looking for.

We’ll review your note and come back with proposed next steps.